Las memecoins, con sus divertidos nombres y promesas de ganancias rápidas, han atraído la atención de muchos inversores, pero también han creado un espacio donde los riesgos son tan altos como las recompensas potenciales.

Este artículo tiene como objetivo desglosar dos conceptos clave que todo inversor en memecoins debe entender: los robos de tokens (o rug pulls) y la quema de tokens, además de proporcionar consejos prácticos para aquellos que se aventuran por primera vez en este mercado.

¿Qué son las Memecoins?

Las memecoins son criptomonedas inspiradas en memes de internet, personajes, animales o tendencias virales.

A menudo, se crean como bromas o experimentos sociales, pero algunas han alcanzado una gran popularidad y valor de mercado gracias a sus comunidades en línea.

Ejemplos populares incluyen Dogecoin (DOGE), Shiba Inu (SHIB) y más recientemente, la memecoin $TRUMP, lanzada por el expresidente Donald Trump.

Estas monedas se caracterizan por ser muy volátiles y especulativas, donde su valor se basa más en el sentimiento del mercado y el hype que en fundamentos tecnológicos o casos de uso reales. Como tal, invertir en memecoins es una actividad de alto riesgo que requiere precaución y educación.

Robos de Tokens (Rug Pulls): El Lado Oscuro de las Memecoins

Un robo de tokens, o rug pull, es un tipo de estafa en el mundo de las criptomonedas en la que los creadores de una memecoin desaparecen repentinamente con el dinero de los inversores después de haber inflado artificialmente el valor de la moneda. Esto puede suceder de varias maneras:

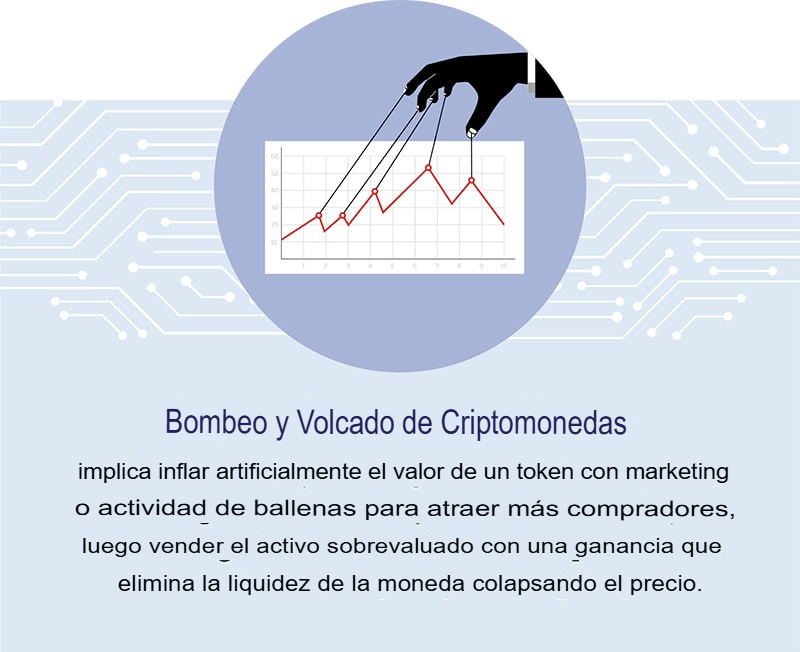

Venta Masiva: Los desarrolladores, que suelen poseer una gran parte de los tokens, los venden todos de golpe tras generar un hype considerable, provocando un colapso en el precio de la moneda y dejando a los demás inversores con pérdidas significativas.

Esto suele ocurrir cuando la propiedad del contrato inteligente de la memecoin no se ha renunciado, permitiendo a los desarrolladores modificar el suministro de tokens y manipular el código.

Retirada de Liquidez: Los creadores retiran la liquidez del pool de liquidez del exchange descentralizado, impidiendo que los demás usuarios puedan vender sus tokens. Esto deja a los inversores con tokens sin valor.

Honeypots: Los contratos inteligentes son manipulados de tal manera que permiten comprar tokens, pero impiden que estos sean vendidos. Los inversores se encuentran atrapados con tokens que no pueden liquidar.

Identificando Señales de Alerta

Para protegerte de un rug pull, es crucial estar atento a las siguientes señales de alerta:

Anonimato del Equipo: Si los creadores de la moneda son anónimos y no hay información pública sobre ellos, es una bandera roja.

Gran Concentración de Tokens: Si una gran parte de los tokens está en manos de pocos individuos, aumenta el riesgo de manipulación. Por ejemplo, el 80% de los tokens $TRUMP estaban en manos de insiders. Es recomendable que los 10 principales poseedores de una memecoin no tengan más del 20-30% del suministro total, excluyendo wallets que proveen liquidez.

Falta de Transparencia: La ausencia de un roadmap, whitepaper o información sobre la tokenómica es una señal de que el proyecto podría no ser legítimo.

Promesas Irrealistas: Si el proyecto promete retornos extraordinarios en poco tiempo, es probable que sea una estafa.

Falta de Liquidez: Si la moneda tiene baja liquidez, puede ser difícil vender sin afectar su precio y podría ser una señal de un futuro rug pull. La liquidez también es importante para atraer grandes capitales a la memecoin.

Contrato No Renunciado: Es preferible que la propiedad del contrato de la memecoin se haya renunciado, lo cual impide que los desarrolladores puedan cambiarlo.

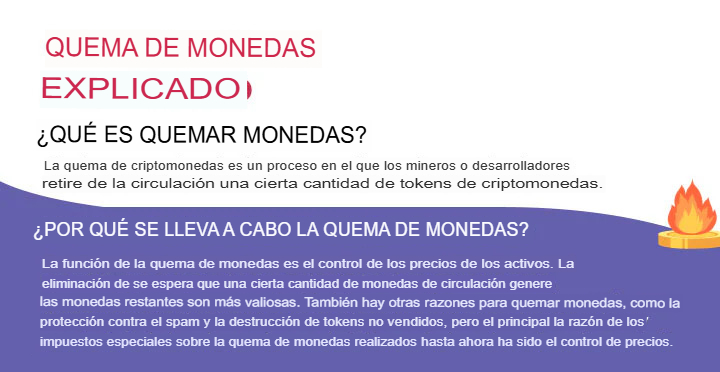

Quema de Tokens: Reduciendo el Suministro

La quema de tokens es el proceso de enviar permanentemente tokens a una wallet inutilizable, reduciendo así el suministro total de la criptomoneda.

Esto puede influir positivamente en el precio de una memecoin, ya que la disminución de la oferta puede generar un aumento en la demanda, aunque no garantiza ganancias. Sin embargo, no es un indicador de que el proyecto sea legítimo o que tenga un valor inherente.

¿Por qué se queman tokens?

Deflación: La quema de tokens puede ayudar a crear una economía deflacionaria, donde el valor de cada token puede aumentar con el tiempo al reducirse la oferta.

Reducción de la Manipulación: Al reducir la cantidad de tokens en circulación, se puede disminuir el riesgo de manipulación de precios.

Atracción de Inversores: La quema de tokens puede generar interés en la moneda y atraer nuevos inversores, impulsando su precio.

Consejos Clave para Nuevos Inversores en Memecoins

- Educación Primero: Antes de invertir, aprende los fundamentos de la tecnología blockchain, las criptomonedas y cómo funcionan las memecoins. Busca fuentes confiables y comunidades con experiencia.

- Investiga a Fondo: No te dejes llevar por el hype. Investiga el proyecto, su equipo, su tokenómica, su roadmap y su comunidad. Utiliza herramientas como Birdeye para verificar si la propiedad del contrato ha sido renunciada y la distribución de tokens.

- Sé Cauteloso: Las memecoins son inversiones de alto riesgo. Invierte solo dinero que estés dispuesto a perder.

- Diversifica: No pongas todo tu dinero en una sola memecoin. Diversifica tu portafolio para minimizar el riesgo.

- Establece una Estrategia de Toma de Ganancias: Decide cuándo vender tus tokens para asegurar tus ganancias y evitar pérdidas. No te dejes llevar por la emoción de ver cómo el precio sube, ya que puede caer tan rápido como subió.

- Ten Cuidado con la Manipulación: No confíes en promesas de ganancias rápidas y desconfía de grupos que promueven una moneda específica.

- Liquidez: Comprueba la liquidez de la memecoin. Una buena liquidez significa que los inversores pueden comprar y vender sin afectar drásticamente el precio.

- Atención, Viralidad: Una memecoin exitosa necesita atención y viralidad. Comprueba su presencia en redes sociales y si tiene una narrativa o historia que la sustente.

- Comunidad: Busca una comunidad fuerte y activa en torno a la memecoin, ya que este es un pilar de muchas memecoins.

- No Inviertas Impulsivamente: Toma tu tiempo para analizar y tomar decisiones informadas. No te dejes llevar por el miedo a perderte la próxima gran cosa.

- Adopta una Estrategia de Barbell: Considera combinar inversiones en memecoins con otras criptomonedas más establecidas como Bitcoin o Ethereum.

- Sé Consciente de los Riesgos de Seguridad: Ten cuidado al comprar en sitios web no oficiales y protege tus wallets de posibles ataques.

Ejemplos de Memecoins y Casos Relevantes

Dogecoin (DOGE): Creada como una broma, alcanzó popularidad con el apoyo de celebridades como Elon Musk.

Shiba Inu (SHIB): Otra memecoin que intentó emular el éxito de Dogecoin.

Pepe (PEPE): Una memecoin basada en el famoso meme de internet, que ha atraído mucha atención.

Dogwifhat (WIF): Una memecoin del ecosistema Solana, que ha tenido un crecimiento explosivo, y que Cryptonary reportó inicialmente en $0.004.

$TRUMP: La memecoin lanzada por el expresidente Donald Trump, cuyo valor ha experimentado gran volatilidad desde su lanzamiento. Esta moneda ha ganado gran atención mediática, pero sus términos y condiciones destacan que no está destinada a ser una oportunidad de inversión, sino más bien una expresión de apoyo y compromiso con las ideas de Donald Trump.

World Liberty Financial (WLF): Proyecto cripto impulsado por Trump, con un token de gobernanza (WLFI) que no cotiza en el mercado, sino que se utiliza para participar en la comunidad.

El Caso de la Memecoin de Trump

El lanzamiento de la memecoin $TRUMP por parte del expresidente Donald Trump es un caso ejemplar de cómo una memecoin puede capturar la atención del público. Si bien algunos inversores vieron ganancias exponenciales (de 10x a 20x), esta moneda también suscitó preocupaciones sobre la concentración de tokens (80% en manos de insiders), su alta volatilidad, y la ética de un expresidente involucrado en un activo especulativo.

A pesar de las advertencias sobre su naturaleza no inversora, muchos seguidores de Trump la compraron, y plataformas como Binance y Coinbase han anunciado que comenzarán a ofrecer esta memecoin. La experiencia de la memecoin de Trump sirve como recordatorio de que las memecoins pueden ser riesgosas, volátiles y propensas a la manipulación.

Conclusión

Las memecoins pueden ofrecer oportunidades para obtener ganancias rápidas, pero también conllevan riesgos significativos. Los rug pulls son una amenaza real y los inversores deben estar bien informados y ser cautelosos antes de participar en este mercado. Una estrategia sólida, educación y diversificación son clave para cualquier persona que se aventure en el mundo de las memecoins. No inviertas ciegamente, y recuerda que, en muchos aspectos, las memecoins son más parecidas a una apuesta en un casino, pero con una volatilidad potencialmente más alta, donde se necesita un enfoque estratégico y un buen manejo del riesgo. Al final, la clave está en entender la tecnología subyacente y cómo aprovecharla sin sucumbir al hype. La decisión de invertir en memecoins debe ser una que se tome con conocimiento, precaución y una clara comprensión de los riesgos involucrados.